Good morning,

Market Highlights

- BMD February crude palm oil up 42 ringgit, 1.28%, to 3330.

- February RBD Palm Oil is down $2.50 to $847.50. However, the AMJ and JAS positions are up $10 to 12 per MT.

- The Malaysian Ringgit continues its strength versus the USD at 4.088. Just a reminder, as the Ringgit gets stronger, it makes palm oil more expensive for the USD buyers.

Malaysian Ringgit

Source of chart: Refinitiv

Source of chart: Refinitiv

- In other macro news, we have Brent crude oil breaking thru $45 per barrel and globally equities higher. The news wires are focusing on the Covid vaccine with reports that the vaccine could be administered before the end of the year. Definitely some supportive headline news giving hope to improving conditions in the next 6 to 9 months. It will be interesting to see how the forward looking view of the market is (or is not) offset by the worsening conditions around the country today.

- CBOT January soybean oil is higher this morning at 38.64. Friday, the market backed off its highs closing at 38.30. Last night, bean oil rallied with soybeans which are 15 cents higher this morning. Market factors have not changed. China’s appetite is voracious, South America needs rain (they got some to allow some planting in Argentina), and the US is rationing soybeans going forward. Cash veg oil in the US is very tight with basis levels in all products increasing this week.

- The soybean oil chart below shows we have closed outside the trend channel for several days now. I look for support to follow the outer band of the channel while resistance is 39 cents.

CBOT January Soybean Oil

Source of chart: Refinitiv

Source of chart: Refinitiv

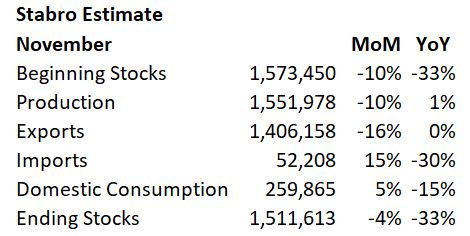

- MPOA and SPPOMA released production estimates for Nov 1-20 this weekend with a range of 10.5 to 11%. Remember, MPOA and SPPOMA combined covers less than 50% of total production for Malaysia. Traders, though, are pricing in a 10% drop in palm production. Using the ITS/AmSpec export estimate (down 16%) released Friday, we would expect stocks to come in just north of 1.5mm MT but down 4% versus October and down 33% from the year prior. Based on recent trends, I would expect a range for production down 8 to 10% and exports down 13 to 16%. So it will be interesting to see what the wires start predicting a week from now.

- The trade last night started quite weak with China leading the way lower. On the chart below, we did make a run at filling the gap from 11/11. Traders just do not seem to like gaps in charts. But once they came back from lunch, they were reminded of weak production and the market shot up off the lows to close up a little more than 1% but still off of last weeks highs. The overall trading range last night was 150 points or almost 5%. Look for resistance at 3400 and support around 3290. An argument could be made that the 11/11 gap was not filled completely so maybe a draw at 3173. That small gap and fund profit taking are the only reasons I can see for the market to ease for the time being. Fundamentals remain the story at hand and they are bullish.

BMD January Palm Oil

Source of chart: Refinitiv

Source of chart: Refinitiv