Today, the USDA issued its monthly WASDE and for the most part it was quite bullish as evidenced by the corn market up 17 cents and soybeans up 40 cents per bushel. The USDA decreased crop production and increased exports across the board. Yields were reduced for both corn and beans while harvested area was unchanged as a result of drought conditions and derecho winds. The trade agreement with China is expected to encourage continued purchases from the US.

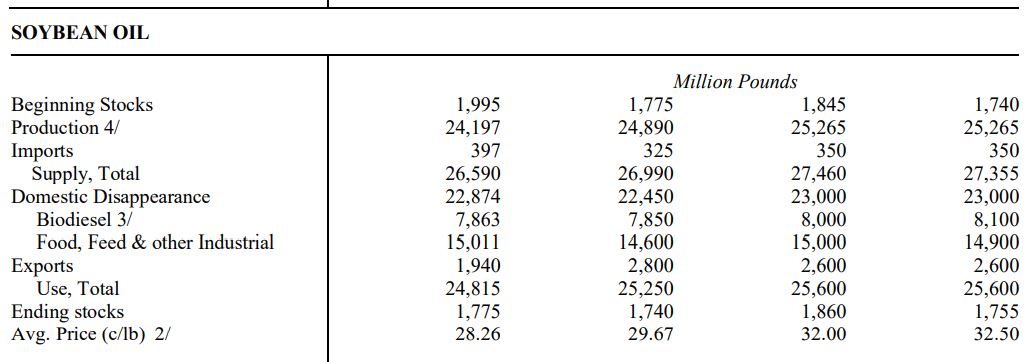

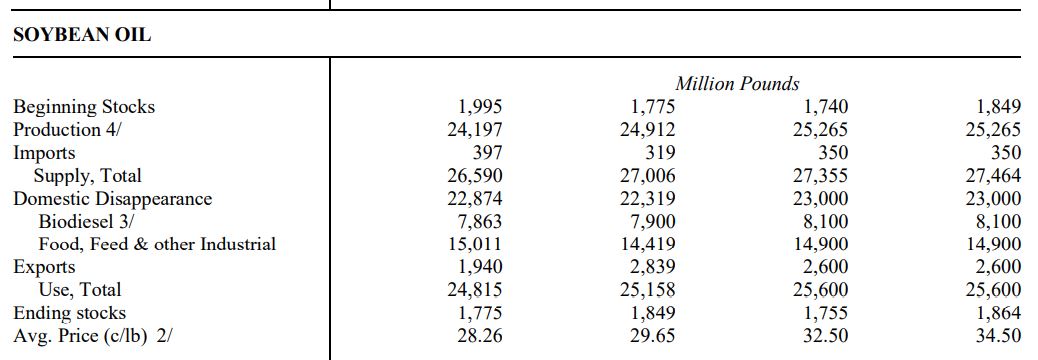

So I was asked to find something bearish in the USDA report, challenge accepted. When looking at the soybean oil balance sheet between the October and November reports, notice the ending stocks for 19/20 crop year was reduced by more than 100 million pounds. The culprit? Reduced food demand by almost 180 million pounds offset by increased exports and biodiesel demand.

As a result, soybean meal is absorbing much of the rally today. Soybean oil is up 50 points as I write this but oil share is lower, testing 31%. As we have been saying, soybean oil has not rallied with palm the last 3 months causing the palm soy spread to move to palm being a premium to soy. This could add further resistance to a steep rally in soybean oil helping to keep palm oil in check. Either way, this addition of supply to the soybean oil balance sheet is my one bearish find for the WASDE report.

October Soybean Oil Balance Sheet per USDA WASDE

November Soybean Oil Balance Sheet per USDA WASDE